Consumer Information

Consumer Guide to the North Carolina Real Estate Commission

Buying a home is often the single biggest investment a person can make. Selling a home can be an overwhelming and confusing transaction.

Because of the size and complexity of home-buying or selling process, most buyers and sellers hire a professional broker to help

them with the process. The North Carolina Real Estate Commission (NCREC) is responsible for licensing real estate brokers in North

Carolina to ensure they are qualified to advise consumers about these transactions. If you are looking for information about the home

buying or selling process be sure to check out our consumer resources page where we highlight tools that could help you.

Buying a home is often the single biggest investment a person can make. Selling a home can be an overwhelming and confusing transaction.

Because of the size and complexity of home-buying or selling process, most buyers and sellers hire a professional broker to help

them with the process. The North Carolina Real Estate Commission (NCREC) is responsible for licensing real estate brokers in North

Carolina to ensure they are qualified to advise consumers about these transactions. If you are looking for information about the home

buying or selling process be sure to check out our consumer resources page where we highlight tools that could help you.

Why are real estate brokers required to be licensed?

Real estate brokers are licensed for the protection of consumers. Before someone can be licensed to act for a buyer or seller in a real

estate transaction, or to act as a property manager, the person must meet certain requirements. To become licensed, each applicant must

pass a background check to assess their honesty, trustworthiness, and integrity. Applicants must also complete qualifying education and

experience, and pass the licensing exam, before they are granted the authority to help guide you through the complicated process of buying

or selling a home. Upon initial licensure, a broker receives their license on provisional status and may only provide brokerage services

under the supervision of a Broker-in-Charge.. Within 18 months of licensure, a broker must take additional coursework to remain an active

broker.

Real estate brokers are licensed for the protection of consumers. Before someone can be licensed to act for a buyer or seller in a real

estate transaction, or to act as a property manager, the person must meet certain requirements. To become licensed, each applicant must

pass a background check to assess their honesty, trustworthiness, and integrity. Applicants must also complete qualifying education and

experience, and pass the licensing exam, before they are granted the authority to help guide you through the complicated process of buying

or selling a home. Upon initial licensure, a broker receives their license on provisional status and may only provide brokerage services

under the supervision of a Broker-in-Charge.. Within 18 months of licensure, a broker must take additional coursework to remain an active

broker.

Most companies that provide brokerage services must be licensed as a firm broker and must operate under the direct oversight of an individual who also holds a broker license (a Broker-in-Charge). Brokers-in-Charge are licensed brokers who take additional education and have obtained the requisite experience to supervise other brokers and to oversee a firm’s trust accounts.

NCREC enforces the laws and rules which govern real estate brokers. If you have issues or concerns with the broker assisting you, or if you feel you are not being represented fairly, you can file a complaint with NCREC. NCREC has the authority to take disciplinary action against a licensed broker who is not in compliance with the rules and laws of North Carolina.

Licensed brokers are required by the law of agency to put your interests as their client above all others, including the broker’s own interests. This is called acting as a “fiduciary” and requires brokers to:

- inform the client of any material information about the property or the transaction received by the broker;

- answer the client’s questions and present any offer to, or counter offer from, the client; and

- treat all parties to a real estate transaction honestly and fairly.

Finally, licensed brokers are required to provide certain consumer notices to you. The first time you communicate with a broker, prior to any discussion in which you release any confidential information, the broker is required to review with you with a disclosure form called, "Working with Real Estate Agents". This form describes the different ways a licensed broker can represent you, if you so choose. More detailed information is also available to you in a companion brochure, Questions and Answers on: Working with Real Estate Agents. Signing the disclosure form acknowledges your receipt of the form but does not create a contract between you and the broker.

Do your homework before choosing a broker.

It’s important to make sure you work with a broker that you believe will best meet your needs. Talk to a trusted neighbor, family member or friend to get a recommendation. Be sure to interview any persons you may be interested in hiring and ask them questions about their services. Online research can also be a valuable aid in helping you decide. Confirm your potential broker is licensed by using NCREC's Licensee Database Search tool and browse our consumer resources tab, where we highlight tools available for buyer, sellers, landlords, and tenants.

Fees are not regulated by the NCREC.

The NCREC does not regulate the fees paid to any real estate broker, including buyer’s agents, listing agents, or property managers. All fees are set by your agreement with each professional. Before you sign any agency agreement or property management agreement, you should carefully review the fees each individual or firm will be charging.

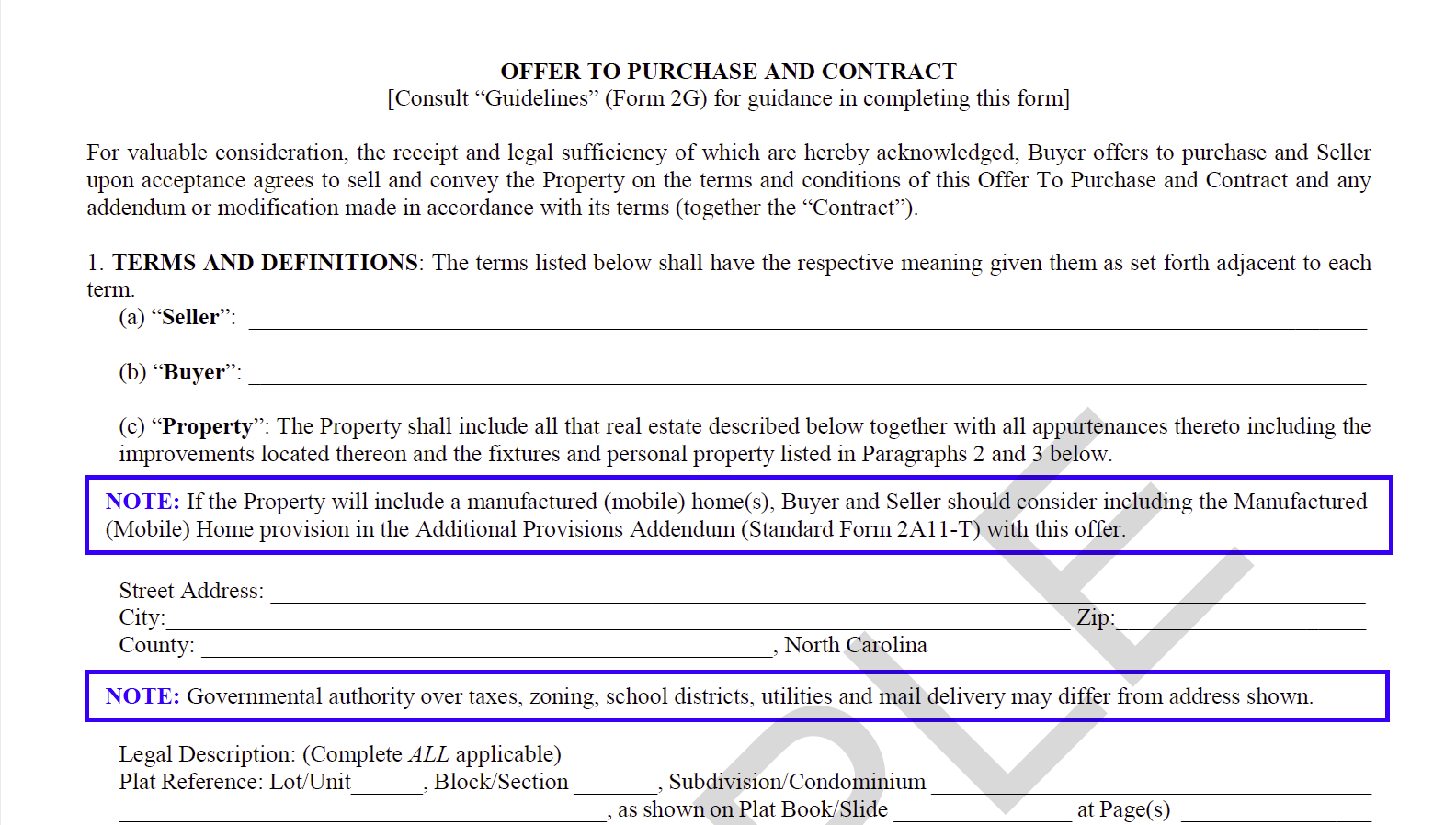

Standard Contract Forms

The NCREC does not require the use of any standard form contracts or addenda. However, there are standard form contracts and addenda

drafted by the North Carolina Association of Realtors® together with the North Carolina Bar Association. These forms are made available to

Realtor members or through a licensed North Carolina attorney.

The NCREC does not require the use of any standard form contracts or addenda. However, there are standard form contracts and addenda

drafted by the North Carolina Association of Realtors® together with the North Carolina Bar Association. These forms are made available to

Realtor members or through a licensed North Carolina attorney.

Many licensed brokers are also members of the National Association of Realtors®. A broker licensed by NCREC is not required to become a REALTOR®; although many do voluntarily join this private professional organization.

A broker is permitted to complete these form contracts to reflect the needs and wishes of their client, but should not make recommendations or offer advice which exceeds their level of expertise. Complex or specialized situations may require the use of an attorney to express and protect your interest.

What about other people involved in the buying and selling of a property?

In addition to licensed real estate brokers, there are other people providing services in the buying and selling of a home, commercial property, or vacant land. These professionals are generally licensed by other agencies. Below are highlighted just a few of the other service providers that might be involved in the home buying process. If you are a buyer or seller, you may wish to review the NCREC’s Q&As on Due Diligence, Home Inspections, Well Water, and Closings for further information about other service providers.

Home Inspectors

Home inspectors are individuals licensed by the North Carolina Home Inspector Licensure Board (NCHIILB) to perform inspections of real

property that is part of a real estate transaction. Inspectors provide information on the performance of certain systems that are part

of the property. Information concerning licensed home inspectors can be found on the

NCHIILB website, in the NCREC

Q&A on Home Inspections, and in a series of

videos

on the Commission’s website.

Home inspectors are individuals licensed by the North Carolina Home Inspector Licensure Board (NCHIILB) to perform inspections of real

property that is part of a real estate transaction. Inspectors provide information on the performance of certain systems that are part

of the property. Information concerning licensed home inspectors can be found on the

NCHIILB website, in the NCREC

Q&A on Home Inspections, and in a series of

videos

on the Commission’s website.

Appraisers

Whenever a loan is involved with a real estate transaction, the property will need to be appraised. An appraisal is essentially a

written estimate of a home or property’s value based on current market conditions. This estimate is determined by a licensed appraiser

and is delivered in an official appraisal report. In most cases, the appraisal will be requested by the buyer’s lender because the

lender is looking for assurance that the property is sufficient collateral and worth the amount that the borrower has agreed to pay.

A buyer or seller can also independently order an appraisal in order to determine a property’s value. Appraisers are licensed by the

North Carolina Appraisal Board (NCAB). Information concerning licensed appraisers can be found on the

NCAB website.

Whenever a loan is involved with a real estate transaction, the property will need to be appraised. An appraisal is essentially a

written estimate of a home or property’s value based on current market conditions. This estimate is determined by a licensed appraiser

and is delivered in an official appraisal report. In most cases, the appraisal will be requested by the buyer’s lender because the

lender is looking for assurance that the property is sufficient collateral and worth the amount that the borrower has agreed to pay.

A buyer or seller can also independently order an appraisal in order to determine a property’s value. Appraisers are licensed by the

North Carolina Appraisal Board (NCAB). Information concerning licensed appraisers can be found on the

NCAB website.

Surveyors

A property survey confirms a property’s boundary lines and true size. It also determines other restrictions or easements included in

the property or undiscovered encroachments. A survey can also assist a potential property owner in planning for future additions or

new uses, such as adding a pool, patio, or fence. Surveyors are licensed by the North Carolina Board of Examiners for Engineers and

Surveyors. Information concerning licensed appraisers can be found on the

Board’s website.

A property survey confirms a property’s boundary lines and true size. It also determines other restrictions or easements included in

the property or undiscovered encroachments. A survey can also assist a potential property owner in planning for future additions or

new uses, such as adding a pool, patio, or fence. Surveyors are licensed by the North Carolina Board of Examiners for Engineers and

Surveyors. Information concerning licensed appraisers can be found on the

Board’s website.

For more information, check out the links under the Consumer tab on the Commission’s website or call us at

919-875-3700.

For more information, check out the links under the Consumer tab on the Commission’s website or call us at 919-875-3700.